In today’s fast-paced world, having access to affordable health insurance is more important than ever. With rising healthcare costs and the unpredictability of life, securing a health insurance plan that fits your budget can provide peace of mind and financial security. If you’re based in the UK and looking for cost-effective health insurance options in 2025, you’re in the right place. This guide will walk you through the top 5 cheap health insurance options in the UK, helping you make an informed decision.

Why Health Insurance is Essential in the UK

While the UK boasts the National Health Service (NHS), which provides free healthcare to residents, many people opt for private health insurance to access faster treatments, private rooms, and specialist care. Health insurance can also cover treatments and services not available on the NHS, such as dental care, optical care, and alternative therapies.

However, finding a plan that balances affordability and comprehensive coverage can be challenging. Below, we’ve curated a list of the top 5 cheap health insurance options in the UK for 2025.

Top 5 Cheap Health Insurance Options in the UK (2025)

1. Aviva Health Insurance

Aviva is one of the most trusted names in the UK insurance market, offering flexible and affordable health insurance plans. Their policies are designed to cater to a wide range of budgets and needs.

Key Features:

- Customizable Plans: Choose from core cover or add-ons like dental, optical, and mental health support.

- 24/7 Digital GP Service: Access to virtual consultations anytime, anywhere.

- No-Claim Discounts: Aviva rewards policyholders who don’t make claims with discounts on renewals.

- Cancer Cover: Comprehensive cancer care, including access to cutting-edge treatments.

Why It’s Affordable:

Aviva offers tiered plans, allowing you to select only the coverage you need. Their basic plans are budget-friendly and ideal for individuals or families looking for essential coverage.

2. Bupa Health Insurance

Bupa is a household name in the UK, known for its extensive network of private hospitals and clinics. In 2025, Bupa continues to offer competitive pricing for its health insurance plans.

Key Features:

- Flexible Coverage: Tailor your plan to include outpatient care, mental health support, or alternative therapies.

- Rapid Access to Specialists: Skip NHS waiting times and see a specialist within days.

- Health Assessments: Free annual health checks to monitor your well-being.

- Global Coverage: Optional add-ons for international health insurance.

Why It’s Affordable:

Bupa’s “Basic” plan is one of the cheapest options on the market, providing essential coverage without breaking the bank. They also offer discounts for families and couples.

3. Vitality Health Insurance

Vitality stands out for its unique approach to health insurance, combining coverage with rewards for healthy living. Their plans are not only affordable but also incentivize policyholders to stay active and healthy.

Key Features:

- Rewards Program: Earn points for exercising, which can be redeemed for discounts on gym memberships, Apple Watches, and more.

- Comprehensive Coverage: Includes inpatient and outpatient care, mental health support, and cancer cover.

- Digital Tools: Access to the Vitality app for tracking your health and managing your policy.

- Preventive Care: Free health screenings and vaccinations.

Why It’s Affordable:

Vitality’s rewards program can significantly reduce your premiums if you maintain a healthy lifestyle. Their entry-level plans are also competitively priced.

4. AXA Health Insurance

AXA is another leading provider of affordable health insurance in the UK. Their plans are designed to be flexible, allowing you to choose the level of coverage that suits your budget.

Key Features:

- Modular Plans: Build your own plan by adding or removing modules like dental care or physiotherapy.

- 24/7 Health Support Line: Speak to a nurse or doctor anytime for advice.

- Mental Health Coverage: Includes access to counseling and therapy sessions.

- Cancer Care: Covers diagnostics, treatment, and aftercare.

Why It’s Affordable:

AXA’s modular approach ensures you only pay for what you need. Their basic plans are among the cheapest in the market, making them ideal for budget-conscious individuals.

5. Freedom Health Insurance

Freedom Health Insurance is a smaller provider but has gained popularity for its affordable and straightforward plans. They specialize in offering basic coverage at competitive prices.

Key Features:

- Simple Plans: Easy-to-understand policies with no hidden fees.

- Outpatient Cover: Includes consultations, diagnostics, and therapies.

- No Age Limits: Available to individuals of all ages.

- Quick Claims Process: Fast and hassle-free claims.

Why It’s Affordable:

Freedom Health Insurance focuses on providing essential coverage at low costs. Their plans are perfect for those who want basic protection without unnecessary add-ons.

How to Choose the Right Cheap Health Insurance Plan

With so many options available, selecting the right health insurance plan can feel overwhelming. Here are some tips to help you make the best choice:

1. Assess Your Needs

- Consider your medical history, lifestyle, and any specific health concerns.

- Determine whether you need basic coverage or more comprehensive options like dental or mental health support.

2. Compare Quotes

- Use comparison websites to get quotes from multiple providers.

- Look beyond the price and compare the coverage, exclusions, and benefits.

3. Check for Discounts

- Many providers offer discounts for families, couples, or individuals who maintain a healthy lifestyle.

- Ask about no-claim discounts or loyalty rewards.

4. Read Reviews

- Research customer reviews to gauge the reliability and customer service of the provider.

- Look for feedback on claims processing and overall satisfaction.

5. Understand the Exclusions

- Make sure you know what’s not covered by the policy, such as pre-existing conditions or specific treatments.

Frequently Asked Questions (FAQs)

1. Is private health insurance worth it in the UK?

Yes, private health insurance can be worth it if you want faster access to treatments, private rooms, and specialist care. It’s especially beneficial for those who want to avoid long NHS waiting times.

2. Can I get health insurance with pre-existing conditions?

Most providers exclude pre-existing conditions from coverage, but some may offer limited coverage or higher premiums. It’s best to check with the provider directly.

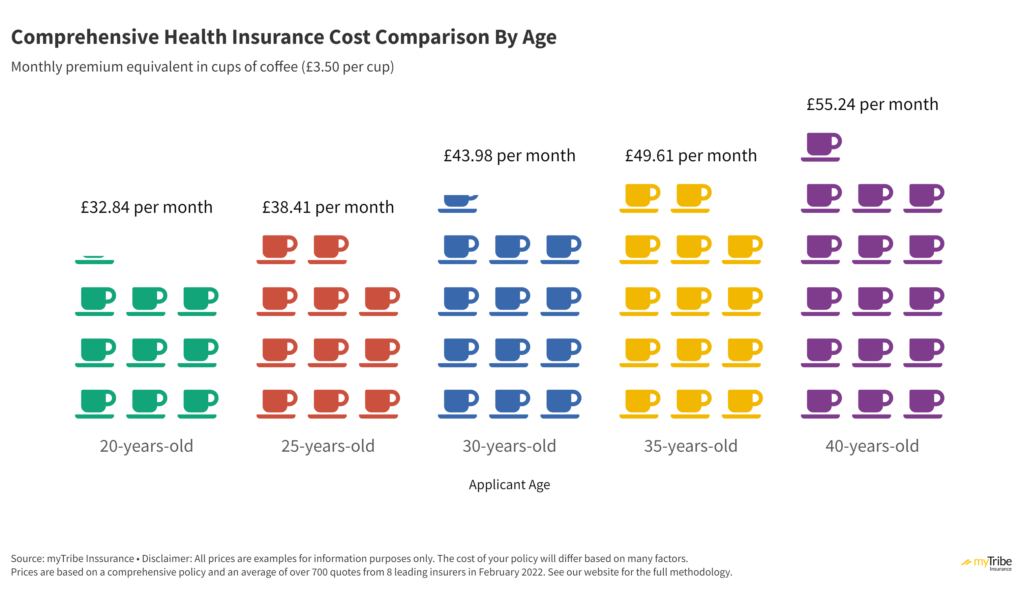

3. How much does health insurance cost in the UK?

The cost of health insurance varies depending on factors like age, health, and coverage level. On average, basic plans can start from as little as £20 per month.

4. Can I switch health insurance providers?

Yes, you can switch providers at any time. However, it’s important to compare policies and ensure there’s no gap in coverage during the transition.

5. Are there any alternatives to private health insurance?

Yes, alternatives include NHS services, cash plans (which cover routine treatments), and health savings accounts.

Final Thoughts

Finding affordable health insurance in the UK doesn’t have to be a daunting task. By comparing the top providers and understanding your needs, you can secure a plan that offers both value and peace of mind. Whether you choose Aviva, Bupa, Vitality, AXA, or Freedom Health Insurance, each of these options provides a balance of affordability and comprehensive coverage.

Remember, the cheapest plan isn’t always the best. Consider your health needs, budget, and long-term goals when making your decision. With the right health insurance, you can protect your well-being and enjoy the benefits of private healthcare without breaking the bank.