In the UK, healthcare is primarily provided by the National Health Service (NHS), a publicly funded system that offers free medical care to all residents. However, in recent years, private health insurance has gained popularity as an alternative or supplement to NHS services. With rising waiting times and increasing demand for healthcare, many people are considering whether private health insurance is worth the cost. This comprehensive guide will explore the pros and cons of private health insurance in the UK, helping you decide if it’s the right choice for you in 2025.

What is Private Health Insurance?

Private health insurance is a type of coverage that allows individuals to access private healthcare services. It typically covers the cost of private hospital treatments, specialist consultations, diagnostic tests, and surgeries. Unlike the NHS, private health insurance offers faster access to care, more personalized treatment options, and greater flexibility in choosing healthcare providers.

How Does Private Health Insurance Work in the UK?

- You pay a monthly or annual premium to an insurance provider.

- The policy covers specific medical treatments and services, depending on the level of coverage you choose.

- When you need medical care, you can access private hospitals and specialists, often with shorter waiting times than the NHS.

- Some policies also offer additional benefits, such as mental health support, dental care, and alternative therapies.

The Pros of Private Health Insurance

1. Shorter Waiting Times

One of the most significant advantages of private health insurance is the reduced waiting time for treatments. The NHS often faces long waiting lists for non-emergency procedures, but private insurance allows you to bypass these delays.

- Example: In 2025, the average waiting time for an NHS hip replacement is 18 weeks, while private patients can often receive treatment within 2-3 weeks.

2. Access to Private Facilities

Private health insurance gives you access to private hospitals and clinics, which often offer more comfortable accommodations and amenities compared to NHS facilities.

- Private rooms with en-suite bathrooms.

- Gourmet meal options.

- Flexible visiting hours for family and friends.

3. Choice of Specialists

With private insurance, you can choose your consultant or specialist, ensuring you receive care from a trusted professional.

4. Comprehensive Coverage

Many private health insurance policies cover a wide range of treatments, including:

- Surgeries.

- Diagnostic tests (e.g., MRI scans, blood tests).

- Cancer treatments.

- Mental health support.

5. Additional Benefits

Some policies include extras like:

- Dental and optical care.

- Physiotherapy.

- Alternative therapies (e.g., acupuncture, chiropractic care).

The Cons of Private Health Insurance

1. High Costs

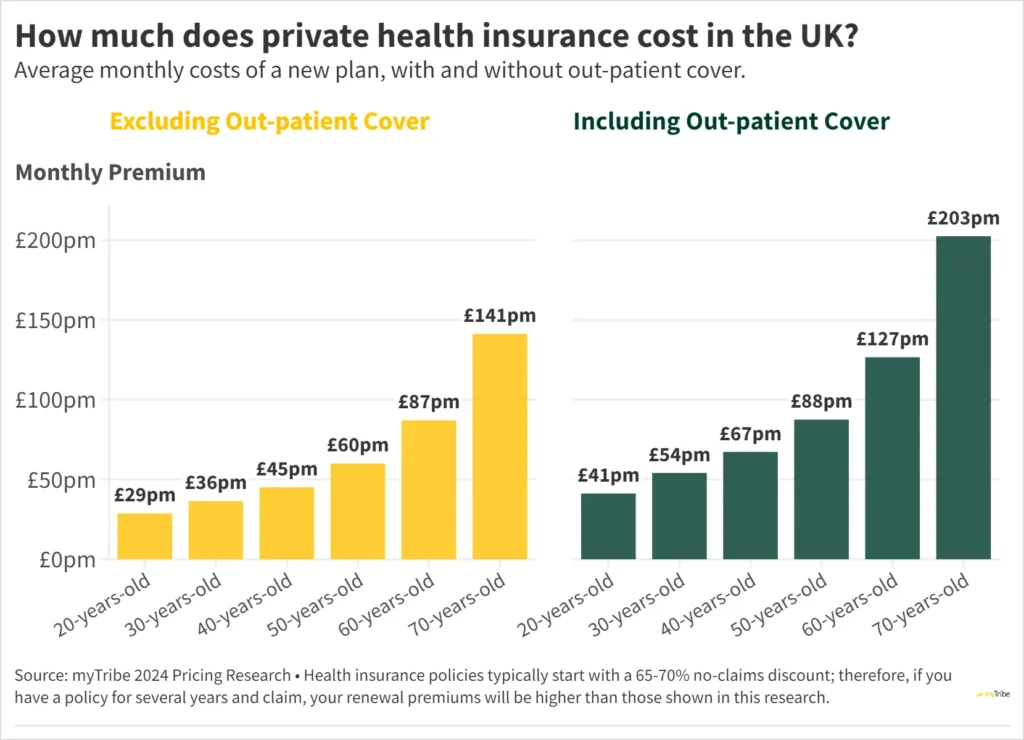

Private health insurance can be expensive, with premiums ranging from £50 to £200+ per month, depending on your age, health, and coverage level.

- Example: A 40-year-old non-smoker might pay £1,200 annually for a mid-tier policy.

2. Exclusions and Limitations

Most policies have exclusions, such as:

- Pre-existing conditions.

- Chronic illnesses (e.g., diabetes, asthma).

- Cosmetic surgeries.

3. Not a Replacement for the NHS

Private health insurance does not cover all medical needs. Emergency care, GP visits, and most primary care services are still provided by the NHS.

4. Complex Policies

Understanding the terms and conditions of private health insurance can be challenging. Policies often have limits, excess fees, and restrictions that may not be immediately clear.

Is Private Health Insurance Worth the Cost in 2025?

The answer depends on your individual circumstances, including your health, budget, and priorities. Here are some factors to consider:

1. Your Health Needs

- If you have a chronic condition or require frequent medical care, private insurance may not be cost-effective due to exclusions.

- If you’re generally healthy but want peace of mind for unexpected illnesses or injuries, it could be a worthwhile investment.

2. Your Financial Situation

- Can you afford the monthly premiums without straining your budget?

- Would you be better off saving the money for potential private treatments as needed?

3. Your Tolerance for Waiting Times

- Are you willing to wait for NHS treatment, or do you prioritize faster access to care?

4. Your Age

- Younger individuals may find private insurance less necessary, while older adults may benefit from the additional coverage.

Types of Private Health Insurance Policies

1. Comprehensive Policies

- Cover a wide range of treatments and services.

- Ideal for those who want maximum coverage and flexibility.

2. Budget Policies

- Offer basic coverage at a lower cost.

- Suitable for individuals who want limited protection for major treatments.

3. Modular Policies

- Allow you to customize your coverage by adding or removing specific benefits.

- Great for tailoring a policy to your unique needs.

4. Family Policies

- Cover multiple family members under a single plan.

- Often more cost-effective than individual policies.

How to Choose the Right Private Health Insurance

1. Assess Your Needs

- Consider your health history, lifestyle, and future medical needs.

2. Compare Providers

- Research different insurance companies and compare their policies, premiums, and customer reviews.

3. Check Coverage Details

- Look for exclusions, limits, and excess fees.

- Ensure the policy covers the treatments and services you’re most likely to need.

4. Seek Professional Advice

- Consult an independent financial advisor or insurance broker to help you make an informed decision.

Top Private Health Insurance Providers in the UK (2025)

Here are some of the leading private health insurance providers in the UK:

- Bupa

- Known for comprehensive coverage and excellent customer service.

- Offers a wide range of policies, including family and modular plans.

- Aviva

- Provides flexible policies with optional add-ons.

- Strong focus on mental health and wellness.

- Vitality

- Rewards healthy lifestyle choices with discounts and perks.

- Offers unique benefits like gym memberships and Apple Watch discounts.

- AXA Health

- Known for transparent pricing and extensive coverage options.

- Offers 24/7 virtual GP services.

- WPA

- Specializes in modular policies, allowing you to build a custom plan.

- Focuses on affordability and flexibility.

Alternatives to Private Health Insurance

If private health insurance isn’t the right choice for you, consider these alternatives:

1. Self-Paying for Private Treatment

- Pay for private treatments as needed, rather than committing to monthly premiums.

- Suitable for those who rarely need medical care.

2. Health Cash Plans

- Cover routine healthcare costs, such as dental check-ups and optical care.

- More affordable than comprehensive private insurance.

3. NHS Top-Up Insurance

- Covers the cost of private treatments that are not available on the NHS.

- A middle ground between NHS care and full private insurance.

Final Thoughts: Is Private Health Insurance Worth It?

Private health insurance can be a valuable investment for those who prioritize faster access to care, personalized treatment, and additional healthcare benefits. However, it’s not a one-size-fits-all solution. Before committing to a policy, carefully weigh the costs and benefits, and consider your unique health needs and financial situation.

In 2025, with the NHS under increasing pressure, private health insurance offers a viable alternative for those who can afford it. Whether it’s worth the cost ultimately depends on your individual circumstances and priorities. By doing your research and comparing policies, you can make an informed decision that best suits your needs.

Key Takeaways

- Private health insurance provides faster access to treatments and greater choice of specialists.

- It can be expensive, with premiums ranging from £50 to £200+ per month.

- Policies often exclude pre-existing conditions and chronic illnesses.

- Alternatives include self-paying for private treatment, health cash plans, and NHS top-up insurance.

- Carefully assess your needs and compare providers before choosing a policy.

2 / 2