Health insurance is a necessity, but it can also be a significant expense. With rising healthcare costs, finding ways to save money on health insurance without sacrificing coverage is more important than ever. Whether you’re self-employed, on a tight budget, or simply looking to cut costs, this guide will provide you with practical tips and strategies to reduce your health insurance expenses while maintaining the coverage you need. Let’s dive in!

Why Saving on Health Insurance Matters

Health insurance is essential for protecting your health and finances, but it doesn’t have to break the bank. Here’s why saving on health insurance is worth the effort:

- Lower Financial Burden: Reduced premiums and out-of-pocket costs free up money for other expenses.

- Access to Quality Care: Affordable insurance ensures you can still see doctors and receive treatments.

- Peace of Mind: Knowing you’re covered without overspending reduces stress.

Key Factors to Consider When Saving on Health Insurance

Before implementing cost-saving strategies, it’s important to understand the factors that influence health insurance costs:

- Premiums: The amount you pay monthly for coverage.

- Deductibles: The amount you pay out-of-pocket before insurance kicks in.

- Copayments and Coinsurance: Fixed fees or percentages you pay for services.

- Out-of-Pocket Maximums: The most you’ll pay in a year for covered services.

- Network Restrictions: In-network vs. out-of-network costs.

Top Strategies to Save Money on Health Insurance

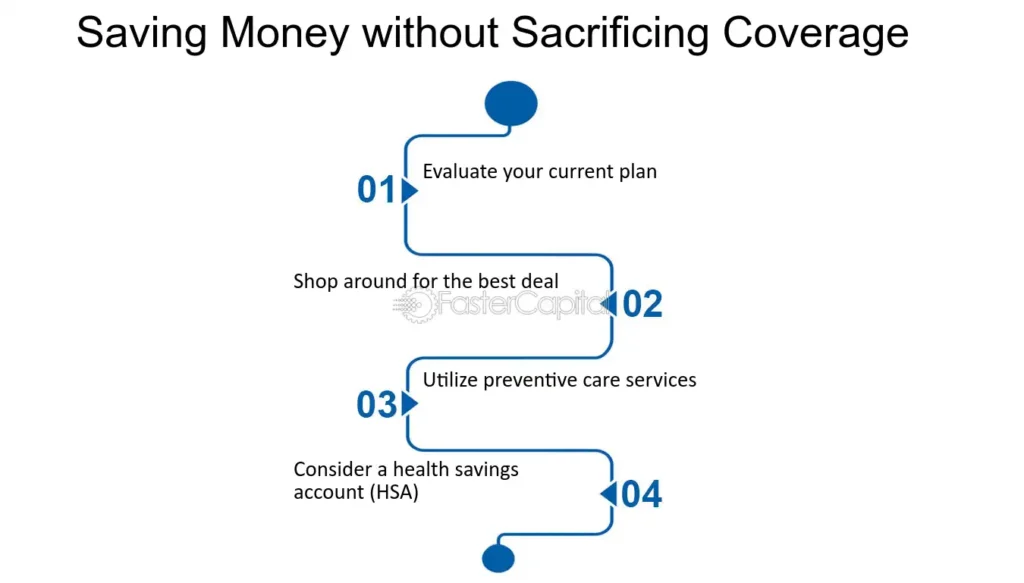

Here are 10 proven strategies to help you save money on health insurance without compromising coverage:

1. Shop Around During Open Enrollment

Overview:

Don’t settle for your current plan without exploring other options.

How to Save:

- Compare plans on the Health Insurance Marketplace or private insurers.

- Look for plans with lower premiums, deductibles, or out-of-pocket costs.

- Use tools like Healthcare.gov or insurance comparison websites.

Benefits:

- You may find a better plan at a lower cost.

- Access to subsidies or tax credits if you qualify.

2. Choose a High-Deductible Health Plan (HDHP) with an HSA

Overview:

HDHPs have lower premiums but higher deductibles, paired with a Health Savings Account (HSA).

How to Save:

- Contribute to an HSA to save for medical expenses tax-free.

- Use HSA funds for qualified medical costs, including deductibles and copays.

Benefits:

- Lower monthly premiums.

- Tax advantages with an HSA.

- Funds roll over year-to-year.

3. Take Advantage of Preventive Care

Overview:

Many plans cover preventive services at no extra cost.

How to Save:

- Schedule annual check-ups, vaccinations, and screenings.

- Detect health issues early to avoid costly treatments later.

Benefits:

- Free or low-cost preventive care.

- Improved long-term health outcomes.

4. Stay In-Network

Overview:

Using in-network providers can significantly reduce your costs.

How to Save:

- Check your plan’s provider directory before scheduling appointments.

- Avoid out-of-network care unless it’s an emergency.

Benefits:

- Lower copays and coinsurance.

- No surprise bills from out-of-network providers.

5. Consider Catastrophic Health Insurance

Overview:

Catastrophic plans are designed for young, healthy individuals who want low premiums.

How to Save:

- Pay lower premiums in exchange for higher deductibles.

- Use the plan for major medical expenses, not routine care.

Benefits:

- Affordable premiums.

- Protection against worst-case scenarios.

6. Look for Subsidies and Tax Credits

Overview:

The Affordable Care Act (ACA) offers financial assistance to eligible individuals.

How to Save:

- Check if you qualify for premium tax credits or cost-sharing reductions.

- Apply through the Health Insurance Marketplace.

Benefits:

- Lower monthly premiums.

- Reduced out-of-pocket costs.

7. Join a Group Plan

Overview:

Group plans through employers or organizations often have lower rates.

How to Save:

- If self-employed, consider joining a professional association or freelancers union.

- Explore spouse or family plans if available.

Benefits:

- Access to group rates.

- Comprehensive coverage options.

8. Use Telehealth Services

Overview:

Many plans now include telehealth options for virtual doctor visits.

How to Save:

- Use telehealth for minor illnesses or consultations.

- Avoid costly in-person visits for non-urgent care.

Benefits:

- Lower copays or free telehealth visits.

- Convenient and time-saving.

9. Review and Adjust Your Coverage Annually

Overview:

Your healthcare needs may change over time, so your plan should too.

How to Save:

- Reassess your coverage during open enrollment.

- Drop unnecessary add-ons or switch to a more cost-effective plan.

Benefits:

- Avoid paying for coverage you don’t need.

- Stay aligned with your current healthcare needs.

10. Negotiate Medical Bills

Overview:

You can often negotiate lower costs for medical services.

How to Save:

- Ask for discounts or payment plans.

- Compare prices for procedures and medications.

Benefits:

- Reduced out-of-pocket expenses.

- More manageable payment options.

Additional Tips for Saving on Healthcare Costs

Beyond health insurance, here are some extra ways to save on healthcare:

- Use Generic Drugs: Opt for generic medications instead of brand-name drugs.

- Shop Around for Procedures: Compare prices for surgeries or tests at different facilities.

- Take Advantage of Wellness Programs: Many insurers offer discounts for healthy behaviors.

- Stay Healthy: Maintain a healthy lifestyle to reduce the need for medical care.

Common Mistakes to Avoid

When trying to save on health insurance, avoid these pitfalls:

- Choosing the Cheapest Plan: Low premiums may mean high out-of-pocket costs.

- Ignoring Network Restrictions: Out-of-network care can be expensive.

- Skipping Preventive Care: Early detection can save money in the long run.

- Not Reviewing Your Plan: Your needs may change, so your plan should too.

Final Thoughts

Saving money on health insurance doesn’t mean you have to compromise on coverage. By shopping around, choosing the right plan, and taking advantage of cost-saving strategies, you can reduce your healthcare expenses while still protecting your health and finances. Remember, the key is to find a balance between affordability and the coverage you need.