Building wealth is a goal that many people aspire to, but it can often feel overwhelming or out of reach. The good news is that with the right strategies, discipline, and a clear plan, anyone can start building wealth, even in the UK’s dynamic economic environment. Whether you’re just starting out or looking to grow your existing assets, this step-by-step guide will walk you through the process of building wealth in the UK.

H2: Understanding Wealth Building

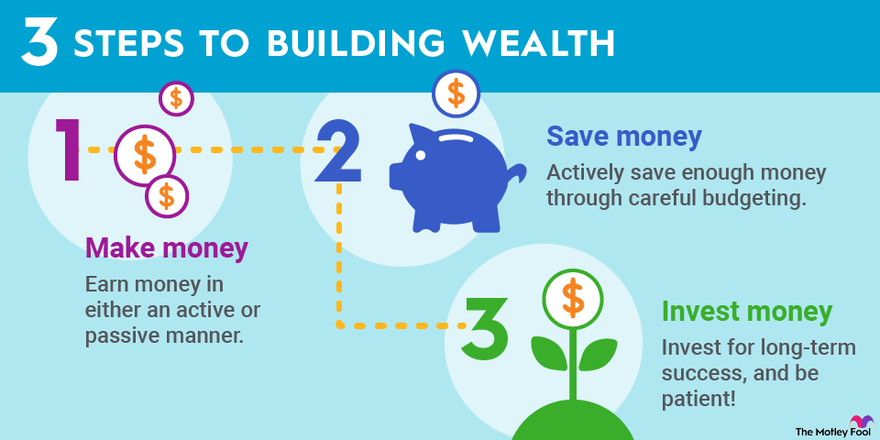

Before diving into the steps, it’s important to understand what wealth building truly means. Wealth is not just about earning a high income; it’s about accumulating assets, reducing liabilities, and creating a sustainable financial future. Building wealth requires a combination of saving, investing, and making smart financial decisions.

H3: Why Building Wealth is Important

- Financial independence: Wealth provides the freedom to make choices without being constrained by money.

- Security: A strong financial foundation protects you and your family during emergencies.

- Legacy: Building wealth allows you to leave a lasting impact for future generations.

H2: Step 1: Assess Your Current Financial Situation

The first step to building wealth is understanding where you stand financially. This involves taking a close look at your income, expenses, debts, and assets.

H3: Calculate Your Net Worth

- Assets: Include savings, investments, property, and other valuables.

- Liabilities: Include debts like mortgages, loans, and credit card balances.

- Net Worth: Subtract your liabilities from your assets to determine your net worth.

H3: Track Your Spending

- Use budgeting apps or spreadsheets to monitor your monthly expenses.

- Identify areas where you can cut back and save more.

H3: Set Financial Goals

- Short-term goals: Saving for a holiday or paying off a small debt.

- Medium-term goals: Buying a car or saving for a house deposit.

- Long-term goals: Retirement planning or building a substantial investment portfolio.

H2: Step 2: Create a Budget and Stick to It

A budget is the foundation of any wealth-building plan. It helps you control your spending, save more, and allocate funds toward your financial goals.

H3: The 50/30/20 Rule

- 50% Needs: Essential expenses like rent, utilities, and groceries.

- 30% Wants: Discretionary spending like entertainment and dining out.

- 20% Savings and Investments: Allocate this portion to building wealth.

H3: Tips for Effective Budgeting

- Automate savings to ensure consistency.

- Review your budget regularly and adjust as needed.

- Avoid lifestyle inflation by sticking to your budget even as your income grows.

H2: Step 3: Build an Emergency Fund

An emergency fund is a crucial safety net that protects you from unexpected expenses like medical bills or job loss.

H3: How Much to Save

- Aim for 3-6 months’ worth of living expenses.

- Start small and gradually build your fund over time.

H3: Where to Keep Your Emergency Fund

- Use a high-interest savings account for easy access and growth.

- Avoid investing this money in volatile assets.

H2: Step 4: Pay Off High-Interest Debt

Debt can be a significant barrier to building wealth, especially high-interest debt like credit cards or personal loans.

H3: Strategies for Debt Repayment

- Debt Snowball Method: Pay off the smallest debts first to build momentum.

- Debt Avalanche Method: Focus on paying off debts with the highest interest rates first.

- Consolidate debts to lower interest rates and simplify payments.

H3: Avoid Accumulating New Debt

- Use credit cards responsibly and pay off balances in full each month.

- Live within your means and avoid unnecessary borrowing.

H2: Step 5: Start Investing Early

Investing is one of the most effective ways to build wealth over time. The earlier you start, the more you can benefit from compound interest.

H3: Types of Investments in the UK

- Stocks and Shares ISAs: Tax-efficient accounts for investing in stocks, bonds, and funds.

- Pensions: Workplace or personal pensions with tax relief benefits.

- Property: Buy-to-let properties or real estate investment trusts (REITs).

- Index Funds and ETFs: Low-cost, diversified investment options.

H3: Tips for Successful Investing

- Diversify your portfolio to spread risk.

- Invest consistently, even during market downturns.

- Seek professional advice if you’re unsure where to start.

H2: Step 6: Maximise Your Income

Increasing your income can accelerate your wealth-building journey. Look for ways to boost your earnings through your career or side hustles.

H3: Career Advancement

- Upskill through courses or certifications to increase your earning potential.

- Negotiate salary raises or promotions at work.

H3: Side Hustles

- Freelancing, blogging, or selling products online.

- Renting out a spare room or property.

H3: Passive Income Streams

- Dividend-paying stocks or bonds.

- Royalties from creative work or intellectual property.

H2: Step 7: Take Advantage of Tax-Efficient Savings

The UK offers several tax-efficient savings and investment options that can help you grow your wealth faster.

H3: Key Tax-Efficient Accounts

- ISA (Individual Savings Account): Up to £20,000 per year can be invested tax-free.

- Lifetime ISA: Save up to £4,000 annually with a 25% government bonus.

- Pension Contributions: Receive tax relief on contributions up to £60,000 per year.

H3: Inheritance Tax Planning

- Use gifting allowances to reduce your estate’s tax liability.

- Consider setting up trusts for long-term wealth preservation.

H2: Step 8: Protect Your Wealth

Building wealth is only half the battle; protecting it is equally important.

H3: Insurance

- Life insurance, health insurance, and income protection.

- Home and contents insurance for property owners.

H3: Estate Planning

- Write a will to ensure your assets are distributed according to your wishes.

- Consider setting up a power of attorney for financial decisions.

H2: Step 9: Continuously Educate Yourself

Financial literacy is key to making informed decisions and adapting to changing circumstances.

H3: Resources for Financial Education

- Books: The Richest Man in Babylon by George S. Clason, Rich Dad Poor Dad by Robert Kiyosaki.

- Podcasts: The Money Podcast by Martin Lewis, Freakonomics Radio.

- Online courses: Platforms like Coursera and Udemy offer finance-related courses.

H3: Stay Informed

- Keep up with economic trends and changes in UK tax laws.

- Regularly review and adjust your financial plan.

H2: Step 10: Stay Disciplined and Patient

Building wealth is a long-term process that requires discipline, patience, and consistency.

H3: Avoid Common Pitfalls

- Impulse spending and lifestyle inflation.

- Emotional decision-making during market volatility.

H3: Celebrate Milestones

- Acknowledge and reward yourself for achieving financial goals.

- Stay motivated by tracking your progress over time.

H2: Final Thoughts

Building wealth in the UK is achievable with the right mindset, strategies, and commitment. By following this step-by-step guide, you can take control of your finances, grow your assets, and secure a prosperous future. Remember, the journey to wealth is not a sprint but a marathon. Start today, stay consistent, and watch your wealth grow over time.