Financial freedom is a goal that many aspire to but few truly understand how to achieve. It’s not just about having enough money to cover your expenses; it’s about having the freedom to live life on your own terms, without being tied down by financial stress. In the UK, where the cost of living continues to rise, achieving financial freedom can seem like a daunting task. However, with the right strategies and mindset, it’s entirely possible. This guide will walk you through the steps you need to take to achieve financial freedom in the UK.

What is Financial Freedom?

Understanding the Concept

Financial freedom means having enough savings, investments, and cash on hand to afford the lifestyle you want for yourself and your family. It means being able to make life decisions without being overly stressed about the financial impact because you are prepared. You are in control of your finances rather than being controlled by them.

Why is Financial Freedom Important?

Financial freedom is important because it provides you with the peace of mind that comes from knowing you can handle whatever life throws at you. Whether it’s an unexpected medical bill, a job loss, or a global pandemic, having financial freedom means you’re prepared. It also allows you to pursue your passions, spend time with loved ones, and enjoy life without the constant worry of money.

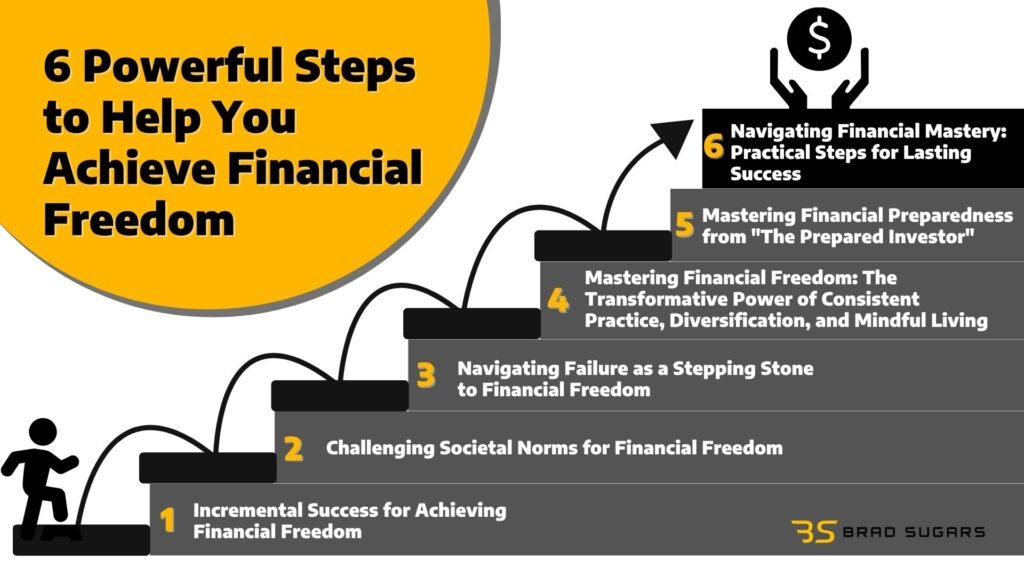

Steps to Achieve Financial Freedom in the UK

1. Assess Your Current Financial Situation

Calculate Your Net Worth

The first step towards achieving financial freedom is understanding where you currently stand. Calculate your net worth by adding up all your assets (savings, investments, property) and subtracting your liabilities (debts, loans). This will give you a clear picture of your financial health.

Track Your Spending

Understanding where your money goes is crucial. Use budgeting apps or spreadsheets to track your income and expenses. Categorize your spending to identify areas where you can cut back.

2. Create a Budget and Stick to It

The 50/30/20 Rule

One popular budgeting method is the 50/30/20 rule:

- 50% of your income should go towards needs (rent, utilities, groceries).

- 30% should go towards wants (entertainment, dining out).

- 20% should go towards savings and debt repayment.

Automate Your Savings

Set up automatic transfers to your savings account as soon as you get paid. This ensures that you’re consistently saving without having to think about it.

3. Pay Off Debt

Prioritize High-Interest Debt

High-interest debt, such as credit card debt, can quickly spiral out of control. Focus on paying off these debts first, as they cost you the most in interest.

Consider Debt Consolidation

If you have multiple debts, consider consolidating them into a single loan with a lower interest rate. This can make it easier to manage your payments and save you money in the long run.

4. Build an Emergency Fund

Why You Need an Emergency Fund

An emergency fund is a safety net that can cover unexpected expenses, such as car repairs or medical bills. Aim to save at least three to six months’ worth of living expenses.

Where to Keep Your Emergency Fund

Keep your emergency fund in a high-interest savings account that’s easily accessible. This ensures that you can get to your money quickly when you need it.

5. Invest for the Future

Start Early

The earlier you start investing, the more time your money has to grow. Even small amounts can add up over time thanks to compound interest.

Diversify Your Investments

Don’t put all your eggs in one basket. Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk.

Consider a Stocks and Shares ISA

In the UK, a Stocks and Shares ISA is a tax-efficient way to invest. You can invest up to £20,000 per year, and any returns you make are tax-free.

6. Increase Your Income

Side Hustles

Consider starting a side hustle to supplement your income. This could be anything from freelance writing to selling handmade crafts online.

Career Advancement

Invest in your education and skills to advance in your career. Higher qualifications and specialized skills can lead to better-paying job opportunities.

7. Reduce Your Expenses

Cut Unnecessary Costs

Review your monthly expenses and identify areas where you can cut back. This could include canceling unused subscriptions, cooking at home instead of eating out, or shopping for deals.

Downsize Your Lifestyle

If your current lifestyle is stretching your finances, consider downsizing. This could mean moving to a smaller home, driving a more affordable car, or cutting back on luxury items.

8. Plan for Retirement

Contribute to a Pension

In the UK, contributing to a workplace pension is one of the most effective ways to save for retirement. Your employer is required to contribute as well, which can significantly boost your savings.

Consider a Private Pension

If you’re self-employed or want to save more, consider opening a private pension. This allows you to make additional contributions and take advantage of tax relief.

9. Protect Your Wealth

Insurance

Make sure you have the right insurance in place to protect your assets. This includes health insurance, life insurance, and home insurance.

Estate Planning

Consider creating a will and setting up a trust to ensure that your wealth is distributed according to your wishes after you pass away.

10. Stay Informed and Adapt

Keep Learning

The financial landscape is constantly changing. Stay informed about new investment opportunities, tax laws, and economic trends.

Review Your Plan Regularly

Your financial situation and goals will change over time. Regularly review and adjust your financial plan to ensure it continues to meet your needs.

Common Mistakes to Avoid

1. Not Having a Plan

Without a clear financial plan, it’s easy to lose sight of your goals. Make sure you have a roadmap that outlines your financial objectives and the steps you need to take to achieve them.

2. Living Beyond Your Means

Spending more than you earn is a surefire way to accumulate debt and hinder your progress towards financial freedom. Stick to your budget and avoid unnecessary expenses.

3. Ignoring Debt

Ignoring your debt won’t make it go away. Face it head-on by creating a repayment plan and sticking to it.

4. Not Investing

Keeping all your money in a savings account may feel safe, but it won’t help you grow your wealth. Invest wisely to take advantage of compound interest and market growth.

5. Failing to Plan for the Unexpected

Life is full of surprises, and not all of them are pleasant. Make sure you have an emergency fund and adequate insurance to protect yourself from unforeseen events.

Conclusion

Achieving financial freedom in the UK is not an overnight process, but with dedication, discipline, and the right strategies, it’s entirely possible. Start by assessing your current financial situation, creating a budget, and paying off debt. Build an emergency fund, invest for the future, and look for ways to increase your income. Reduce your expenses, plan for retirement, and protect your wealth. Stay informed and adapt your plan as needed. By following these steps, you can take control of your finances and achieve the financial freedom you’ve always dreamed of.