Navigating the world of health insurance in Canada can feel overwhelming, especially with so many options available. Whether you’re a newcomer, a family, or a senior, having the right health insurance plan is crucial to ensure you’re covered for unexpected medical expenses. While Canada’s public healthcare system covers many basics, it doesn’t include everything—like prescription drugs, dental care, or vision care. That’s where private health insurance comes in.

In this guide, we’ll break down the best health insurance plans in Canada for 2025, compare their features, and help you save money while choosing the right plan for your needs.

Why Do You Need Health Insurance in Canada?

Canada’s public healthcare system, often referred to as Medicare, provides essential medical services to residents. However, it doesn’t cover everything. Here’s why private health insurance is important:

What’s Covered by Public Healthcare?

- Doctor visits

- Hospital stays

- Emergency services

- Diagnostic tests (e.g., X-rays, blood tests)

What’s NOT Covered by Public Healthcare?

- Prescription medications

- Dental care (for adults)

- Vision care (e.g., glasses, contact lenses)

- Paramedical services (e.g., physiotherapy, chiropractic care)

- Ambulance services (in some provinces)

Private health insurance fills these gaps, ensuring you’re protected from high out-of-pocket costs.

Types of Health Insurance Plans in Canada

1. Individual Health Insurance

- Designed for individuals or families who don’t have coverage through an employer.

- Customizable plans based on your needs.

- Ideal for self-employed individuals, freelancers, or those transitioning between jobs.

2. Group Health Insurance

- Offered by employers to their employees.

- Often includes extended health benefits like dental, vision, and mental health support.

- Premiums are typically shared between the employer and employee.

3. Travel Health Insurance

- Provides coverage for medical emergencies while traveling outside Canada.

- Essential for Canadians who frequently travel abroad.

4. Critical Illness Insurance

- Offers a lump-sum payment if you’re diagnosed with a serious illness like cancer or heart disease.

- Helps cover costs not included in standard health insurance plans.

Top Health Insurance Providers in Canada (2025)

Here’s a breakdown of the best health insurance providers in Canada for 2025:

1. Manulife Financial

- Why Choose Manulife?

- Comprehensive coverage options for individuals, families, and businesses.

- Flexible plans that include dental, vision, and prescription drug coverage.

- Easy-to-use online tools for claims and account management.

- Best For: Families and businesses looking for customizable plans.

2. Sun Life Financial

- Why Choose Sun Life?

- Offers a wide range of health and wellness benefits.

- Includes mental health support and virtual healthcare services.

- Strong reputation for customer service.

- Best For: Individuals seeking mental health and wellness coverage.

3. Blue Cross

- Why Choose Blue Cross?

- Affordable plans with extensive coverage options.

- Specializes in travel health insurance.

- Available in all provinces and territories.

- Best For: Travelers and those looking for budget-friendly options.

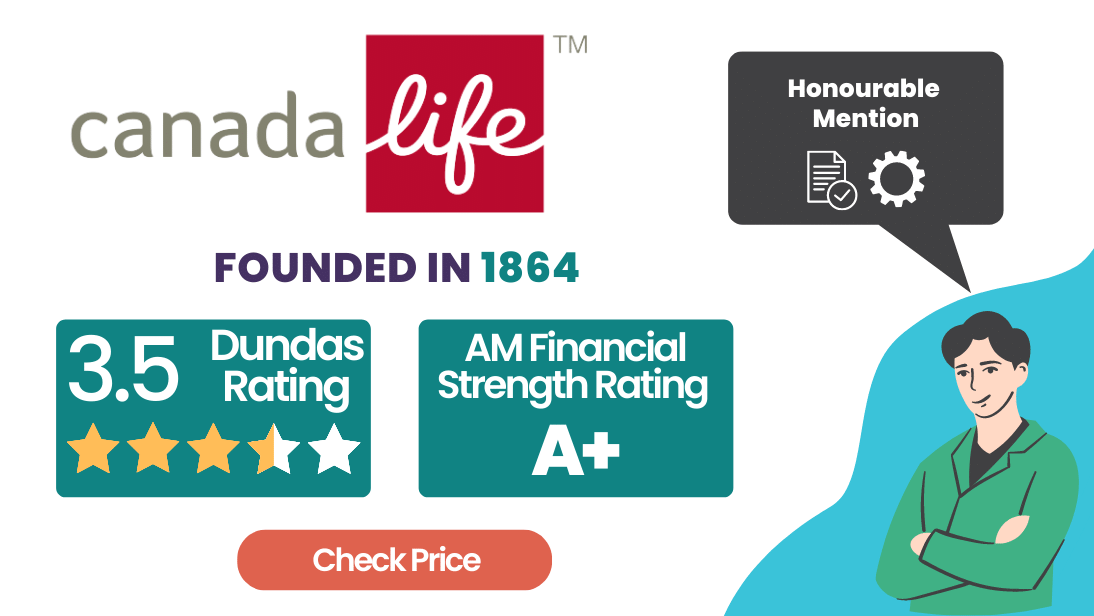

4. Canada Life

- Why Choose Canada Life?

- Offers flexible plans for individuals, families, and groups.

- Includes coverage for paramedical services like physiotherapy and chiropractic care.

- Strong focus on customer satisfaction.

- Best For: Seniors and individuals needing paramedical coverage.

5. Desjardins Insurance

- Why Choose Desjardins?

- Competitive pricing with comprehensive coverage.

- Includes unique benefits like health and wellness rewards programs.

- Available in both English and French.

- Best For: Quebec residents and those seeking wellness incentives.

How to Choose the Best Health Insurance Plan

Step 1: Assess Your Needs

- Consider your age, health condition, and lifestyle.

- Determine which services you need most (e.g., dental, vision, prescription drugs).

Step 2: Compare Plans

- Look at coverage limits, premiums, and deductibles.

- Check for exclusions or waiting periods.

Step 3: Check Provider Networks

- Ensure your preferred doctors, dentists, and specialists are included in the plan’s network.

Step 4: Read Reviews

- Research customer reviews and ratings for the insurance provider.

Step 5: Get Quotes

- Request quotes from multiple providers to compare costs.

Tips to Save Money on Health Insurance

- Bundle Plans: Some providers offer discounts if you bundle health, dental, and vision coverage.

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly premiums.

- Take Advantage of Employer Plans: If your employer offers group health insurance, enroll to save on costs.

- Use Health Spending Accounts (HSAs): HSAs allow you to set aside pre-tax income for medical expenses.

- Review Your Plan Annually: Your needs may change over time, so reassess your plan each year to ensure it’s still the best fit.

Common Mistakes to Avoid When Buying Health Insurance

- Not Reading the Fine Print: Always read the policy details to understand what’s covered and what’s not.

- Overlooking Exclusions: Some plans exclude pre-existing conditions or specific treatments.

- Focusing Only on Price: The cheapest plan may not offer the coverage you need.

- Ignoring Customer Service: Choose a provider with a reputation for excellent customer support.

FAQs About Health Insurance in Canada

1. Is health insurance mandatory in Canada?

- No, private health insurance is not mandatory, but it’s highly recommended to cover gaps in public healthcare.

2. Can I keep my health insurance if I change jobs?

- If you have individual health insurance, yes. If you have group insurance through your employer, you may lose coverage when you leave the job.

3. Are pre-existing conditions covered?

- It depends on the provider and plan. Some plans exclude pre-existing conditions, while others may cover them after a waiting period.

4. How much does health insurance cost in Canada?

- Costs vary based on factors like age, coverage type, and provider. On average, individual plans range from 50to50to200 per month.

Conclusion

Choosing the best health insurance plan in Canada doesn’t have to be complicated. By understanding your needs, comparing plans, and following the tips in this guide, you can find a plan that offers the right coverage at an affordable price. Whether you’re looking for individual, family, or travel health insurance, the options in Canada are diverse and cater to a wide range of needs.

Don’t wait until it’s too late—invest in a health insurance plan today to protect yourself and your loved ones from unexpected medical expenses.