Health insurance is a critical aspect of life in Canada, ensuring that individuals and families have access to necessary medical care without facing financial strain. While Canada’s public healthcare system covers many essential services, there are gaps that require additional coverage. This guide will walk you through everything you need to know about affordable health insurance in Canada, including types of plans, costs, and tips for finding the best coverage for your needs.

H2: Understanding Canada’s Healthcare System

Canada’s healthcare system is publicly funded and provides universal coverage for essential medical services. However, it’s important to understand what is and isn’t covered under the public system to determine if additional health insurance is necessary.

H3: What Does Canada’s Public Healthcare Cover?

- Doctor visits and hospital stays

- Emergency medical services

- Diagnostic tests (e.g., X-rays, blood tests)

- Surgeries and treatments deemed medically necessary

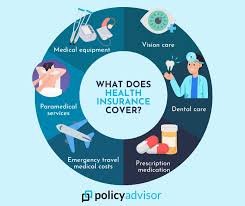

H3: Gaps in Public Healthcare Coverage

- Prescription medications

- Dental care (for adults)

- Vision care (e.g., eye exams, glasses, or contact lenses)

- Paramedical services (e.g., physiotherapy, chiropractic care)

- Ambulance services (in some provinces)

These gaps can lead to significant out-of-pocket expenses, making private health insurance a valuable option for many Canadians.

H2: Types of Health Insurance in Canada

There are several types of health insurance plans available in Canada, each designed to meet different needs and budgets. Understanding these options will help you make an informed decision.

H3: Employer-Sponsored Health Insurance

Many Canadians receive health insurance through their employers. These plans often cover:

- Prescription drugs

- Dental and vision care

- Paramedical services

Pros:

- Often more affordable than individual plans

- Premiums may be partially or fully covered by the employer

Cons:

- Coverage may be limited

- Loss of coverage if you change jobs

H3: Individual Health Insurance Plans

Individual plans are purchased directly from insurance providers and can be tailored to your specific needs. These plans are ideal for:

- Self-employed individuals

- Freelancers or gig workers

- Those without employer-sponsored coverage

Pros:

- Customizable coverage

- Portable (not tied to employment)

Cons:

- Can be more expensive than group plans

- Requires thorough research to find the best plan

H3: Travel Health Insurance

Travel health insurance is essential for Canadians traveling outside the country, as provincial health plans offer limited or no coverage abroad. This type of insurance covers:

- Emergency medical expenses

- Hospital stays

- Medical evacuation

Pros:

- Provides peace of mind while traveling

- Affordable for short-term trips

Cons:

- Not suitable for everyday health needs

H2: How to Find Affordable Health Insurance in Canada

Finding affordable health insurance requires careful research and comparison. Here are some tips to help you get started:

H3: Assess Your Needs

Before purchasing a plan, evaluate your healthcare needs. Consider:

- Your medical history

- Frequency of doctor visits

- Prescription medication requirements

- Dental and vision care needs

H3: Compare Plans and Providers

Use online comparison tools to review different plans and providers. Look for:

- Coverage limits

- Premium costs

- Deductibles and co-pays

- Customer reviews and ratings

H3: Look for Discounts

Some insurance providers offer discounts for:

- Bundling multiple types of insurance (e.g., health and auto)

- Paying premiums annually instead of monthly

- Being a member of certain organizations or associations

H3: Consider a Health Spending Account (HSA)

An HSA is a tax-advantaged account that allows you to set aside money for medical expenses. It’s a great option for self-employed individuals or small business owners.

H2: Top Affordable Health Insurance Providers in Canada

Here are some of the best health insurance providers in Canada known for offering affordable plans:

H3: Sun Life Financial

- Offers customizable individual and family plans

- Covers prescription drugs, dental, and vision care

- Known for excellent customer service

H3: Manulife

- Provides flexible plans with various coverage options

- Includes wellness programs and discounts

- Offers travel health insurance

H3: Blue Cross

- Affordable plans for individuals and families

- Extensive coverage for paramedical services

- Available in all provinces

H3: Desjardins

- Competitive pricing for individual and group plans

- Covers prescription drugs, dental, and vision care

- Offers additional discounts for members

H2: Tips for Saving Money on Health Insurance

Health insurance can be expensive, but there are ways to reduce costs without compromising on coverage.

H3: Choose a Higher Deductible

Opting for a higher deductible can lower your monthly premiums. Just make sure you can afford the deductible if you need to make a claim.

H3: Limit Coverage to Essential Services

If you’re on a tight budget, consider a plan that covers only the services you’re most likely to use, such as prescription drugs or dental care.

H3: Take Advantage of Free Services

Many provinces offer free or low-cost health services, such as flu shots or cancer screenings. Use these services to reduce your reliance on insurance.

H3: Review Your Plan Annually

Your healthcare needs may change over time, so it’s important to review your plan annually and make adjustments as needed.

H2: Frequently Asked Questions (FAQs)

H3: Is health insurance mandatory in Canada?

No, health insurance is not mandatory in Canada. However, private insurance can help cover gaps in the public healthcare system.

H3: Can I get health insurance if I have a pre-existing condition?

Yes, but coverage for pre-existing conditions may be limited or excluded, depending on the provider and plan.

H3: How much does health insurance cost in Canada?

The cost of health insurance varies depending on factors such as age, health status, and coverage level. On average, individual plans can range from 50to50to200 per month.

H3: Can I use my health insurance outside of Canada?

Most provincial health plans offer limited coverage outside of Canada, so it’s recommended to purchase travel health insurance for international trips.

H2: Conclusion

Affordable health insurance in Canada is within reach if you take the time to research and compare your options. Whether you’re looking for coverage for prescription drugs, dental care, or travel emergencies, there’s a plan out there to meet your needs and budget. By understanding the gaps in Canada’s public healthcare system and exploring private insurance options, you can ensure that you and your family are protected against unexpected medical expenses.

Remember to assess your needs, compare plans, and take advantage of discounts to find the best coverage at the lowest cost. With the right health insurance plan, you can enjoy peace of mind knowing that you’re prepared for whatever life throws your way.