Navigating the world of health insurance in Canada can feel overwhelming, especially with the mix of public and private options available. Whether you’re a newcomer, a family, or a retiree, understanding the ins and outs of health insurance is crucial to making the right choice for your needs. In this comprehensive guide, we’ll cover everything you need to know before buying health insurance in Canada, including the types of coverage, costs, and tips for choosing the best plan.

H2: Understanding Canada’s Healthcare System

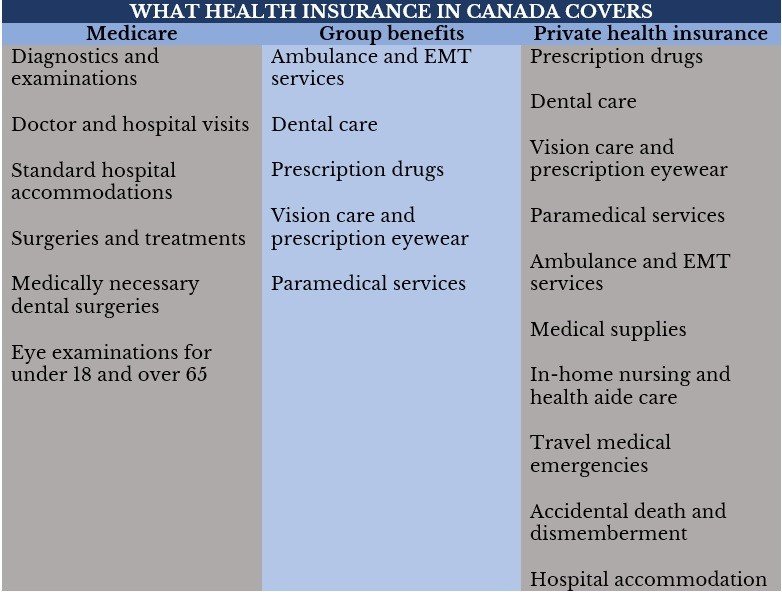

Canada is known for its publicly funded healthcare system, often referred to as Medicare. However, this system doesn’t cover everything, and that’s where private health insurance comes into play.

H3: What Does Canada’s Public Healthcare Cover?

Canada’s public healthcare system provides basic medical services to all citizens and permanent residents. Here’s what it typically includes:

- Doctor visits

- Hospital stays

- Emergency services

- Diagnostic tests (e.g., X-rays, blood tests)

H3: Limitations of Public Healthcare

While public healthcare is a great foundation, it has its limitations:

- No coverage for prescription drugs (outside hospitals)

- Dental care is not included for adults

- Vision care (e.g., eyeglasses, contact lenses) is excluded

- Ambulance services may not be fully covered

- Long-term care and home care are often not included

These gaps make private health insurance a valuable addition for many Canadians.

H2: Types of Health Insurance in Canada

There are two main types of health insurance in Canada: public health insurance and private health insurance. Let’s break them down.

H3: Public Health Insurance

Public health insurance is funded by taxes and administered by each province or territory. It ensures that all residents have access to essential medical services. However, coverage varies slightly between provinces.

H3: Private Health Insurance

Private health insurance fills the gaps left by public healthcare. It can be purchased individually or provided by employers. Here are the main types of private health insurance:

- Supplementary Health Insurance: Covers services not included in public healthcare, such as prescription drugs, dental care, and vision care.

- Travel Health Insurance: Provides coverage for medical emergencies while traveling outside Canada.

- Critical Illness Insurance: Offers a lump-sum payment if you’re diagnosed with a serious illness like cancer or heart disease.

- Disability Insurance: Replaces a portion of your income if you’re unable to work due to illness or injury.

H2: Who Needs Private Health Insurance in Canada?

While public healthcare covers the basics, certain groups of people may benefit significantly from private health insurance:

H3: Newcomers to Canada

Newcomers often face a waiting period (up to 3 months) before they’re eligible for public healthcare. Private health insurance can provide coverage during this gap.

H3: Families

Families may need additional coverage for dental care, vision care, and prescription medications, which are not covered by public healthcare.

H3: Seniors

Seniors often require more frequent medical care, including prescription drugs, home care, and long-term care services.

H3: Self-Employed Individuals

Self-employed individuals don’t have access to employer-sponsored health insurance and may need to purchase their own plans.

H3: Frequent Travelers

If you travel outside Canada frequently, travel health insurance is essential to cover medical emergencies abroad.

H2: How Much Does Health Insurance Cost in Canada?

The cost of private health insurance in Canada varies depending on several factors, including:

- Age: Older individuals typically pay higher premiums.

- Coverage Type: Comprehensive plans cost more than basic plans.

- Health Status: Pre-existing conditions may increase premiums.

- Province: Costs can vary by province due to differences in healthcare coverage.

H3: Average Costs

- Individual Plans: 50to50to150 per month

- Family Plans: 200to200to400 per month

- Travel Insurance: 5to5to10 per day (for short trips)

H2: How to Choose the Best Health Insurance Plan

Choosing the right health insurance plan requires careful consideration. Here are some tips to help you make an informed decision:

H3: Assess Your Needs

- Make a list of the services you need (e.g., dental, vision, prescription drugs).

- Consider your family’s health history and potential future needs.

H3: Compare Plans

- Look at multiple insurance providers and compare their plans.

- Pay attention to coverage limits, exclusions, and waiting periods.

H3: Check for Pre-Existing Condition Coverage

- Some plans exclude pre-existing conditions or impose waiting periods.

- If you have a pre-existing condition, look for a plan that offers coverage.

H3: Read Reviews

- Research customer reviews and ratings of insurance providers.

- Look for feedback on claim processing and customer service.

H3: Consult an Insurance Broker

- An insurance broker can help you navigate the options and find the best plan for your needs.

H2: Top Health Insurance Providers in Canada

Here are some of the leading health insurance providers in Canada:

H3: Sun Life Financial

- Offers a wide range of health insurance plans, including supplementary and critical illness insurance.

- Known for excellent customer service and flexible plans.

H3: Manulife

- Provides comprehensive health insurance plans for individuals, families, and seniors.

- Offers travel insurance and disability insurance.

H3: Blue Cross

- Operates in multiple provinces with a focus on affordable supplementary health insurance.

- Popular for its travel insurance plans.

H3: Great-West Life

- Offers customizable health insurance plans for individuals and groups.

- Known for its strong reputation and reliable coverage.

H2: Tips for Saving on Health Insurance

Health insurance can be expensive, but there are ways to save:

H3: Bundle Plans

- Some providers offer discounts if you bundle multiple types of insurance (e.g., health, dental, and vision).

H3: Choose a Higher Deductible

- Opting for a higher deductible can lower your monthly premiums.

H3: Take Advantage of Employer Plans

- If your employer offers health insurance, take advantage of it, as it’s often more affordable than individual plans.

H3: Stay Healthy

- Maintaining a healthy lifestyle can reduce your need for medical services and lower your premiums over time.

H2: Common Mistakes to Avoid When Buying Health Insurance

H3: Not Reading the Fine Print

- Always read the policy details to understand coverage limits and exclusions.

H3: Underestimating Your Needs

- Don’t choose a plan based solely on cost. Make sure it meets your healthcare needs.

H3: Ignoring Travel Insurance

- Even if you have comprehensive health insurance, it may not cover you outside Canada. Always purchase travel insurance for trips abroad.

H2: Final Thoughts

Health insurance is an essential part of financial planning in Canada. While the public healthcare system provides a strong foundation, private health insurance can help you cover the gaps and protect yourself from unexpected medical expenses. By understanding your needs, comparing plans, and choosing a reputable provider, you can find the best health insurance plan for you and your family.