The UK is renowned for its National Health Service (NHS), which provides free healthcare to all residents. However, with increasing waiting times, limited resources, and growing demand, many people are turning to private health insurance to supplement their healthcare needs. In this comprehensive guide, we’ll explore why private health insurance is becoming essential in the UK, its key benefits, and tips for choosing the right policy.

H2: What is Private Health Insurance?

Private health insurance is a type of coverage that allows you to access private healthcare services, including consultations, diagnostics, treatments, and surgeries. Unlike the NHS, private health insurance gives you more control over your healthcare, including faster access to specialists and treatments.

H3: How Does Private Health Insurance Work?

When you purchase private health insurance, you pay a monthly or annual premium to an insurance provider. In return, the insurer covers the cost of private medical treatments, depending on the level of coverage you choose. Most policies allow you to:

- Choose your preferred hospital or consultant.

- Access treatments and surgeries without long waiting times.

- Receive care in private facilities with enhanced comfort and privacy.

H2: Why Do You Need Private Health Insurance in the UK?

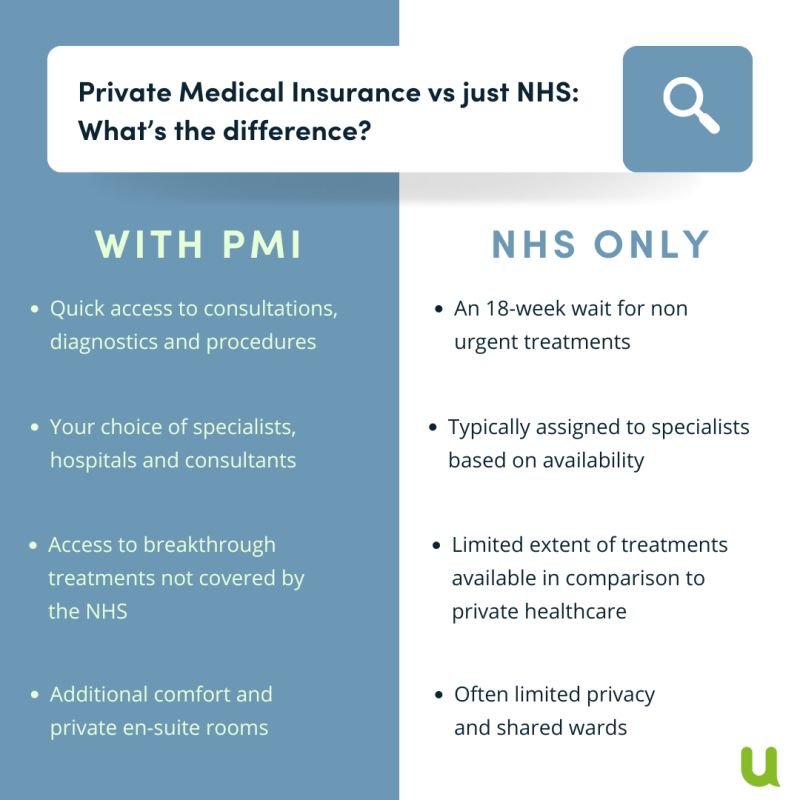

While the NHS provides excellent care, it faces significant challenges, including long waiting lists and limited resources. Here’s why private health insurance is becoming a necessity for many:

H3: 1. Shorter Waiting Times

One of the biggest advantages of private health insurance is faster access to treatments. According to recent statistics, NHS waiting times for non-urgent procedures can stretch to several months or even years. With private insurance, you can often receive treatment within weeks or even days.

H3: 2. Access to Specialist Care

Private health insurance gives you access to top specialists and consultants who may not be available through the NHS. This is particularly beneficial for complex or rare conditions.

H3: 3. Enhanced Privacy and Comfort

Private hospitals and clinics offer a more comfortable and personalized experience, with private rooms, better amenities, and shorter recovery times.

H3: 4. Comprehensive Coverage

Private health insurance often covers treatments and services that are not available on the NHS, such as alternative therapies, mental health support, and dental care.

H3: 5. Peace of Mind

Knowing that you have access to prompt and high-quality healthcare can provide significant peace of mind, especially for those with chronic conditions or families.

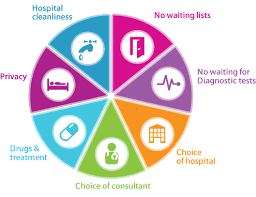

H2: Key Benefits of Private Health Insurance

Private health insurance offers a range of benefits that make it a valuable investment. Here are some of the key advantages:

H3: 1. Faster Diagnosis and Treatment

- Access to diagnostic tests like MRI scans and blood tests without long delays.

- Quicker referrals to specialists for consultations and treatments.

H3: 2. Choice of Hospitals and Consultants

- Freedom to choose your preferred hospital or consultant.

- Access to leading private hospitals with state-of-the-art facilities.

H3: 3. Additional Services and Treatments

- Coverage for therapies like physiotherapy, acupuncture, and chiropractic care.

- Mental health support, including counseling and therapy sessions.

H3: 4. Flexibility and Customization

- Tailor your policy to suit your needs, whether you’re an individual, a couple, or a family.

- Add-ons like dental care, optical care, and travel insurance.

H3: 5. Financial Protection

- Avoid unexpected medical bills by covering the cost of private treatments.

- Some policies even offer cash benefits for hospital stays or surgeries.

H2: Tips for Choosing the Right Private Health Insurance Policy

With so many providers and policies available, choosing the right private health insurance can be overwhelming. Here are some tips to help you make an informed decision:

H3: 1. Assess Your Healthcare Needs

- Consider your age, medical history, and lifestyle.

- Think about the types of treatments and services you’re likely to need.

H3: 2. Compare Policies and Providers

- Use comparison websites to compare premiums, coverage, and exclusions.

- Look for reputable providers with strong customer reviews.

H3: 3. Check the Level of Coverage

- Ensure the policy covers the treatments and services you need.

- Be aware of any exclusions or limitations, such as pre-existing conditions.

H3: 4. Consider Your Budget

- Choose a policy that offers the best value for your budget.

- Look for discounts or family plans to save money.

H3: 5. Read the Fine Print

- Understand the terms and conditions of the policy, including waiting periods and claim processes.

- Ask questions if anything is unclear.

H3: 6. Seek Professional Advice

- Consult an insurance broker or financial advisor for personalized recommendations.

- They can help you navigate complex policies and find the best deal.

H2: Common Misconceptions About Private Health Insurance

Many people hesitate to invest in private health insurance due to misconceptions. Let’s debunk some of the most common myths:

H3: 1. “Private Health Insurance is Too Expensive”

While premiums can vary, there are affordable options available, especially if you’re young and healthy. Many providers offer flexible payment plans and discounts.

H3: 2. “I Don’t Need It Because of the NHS”

While the NHS provides excellent care, it’s under immense pressure. Private health insurance ensures you have access to timely and personalized care when you need it most.

H3: 3. “It’s Only for the Wealthy”

Private health insurance is becoming more accessible to people from all walks of life. Many employers also offer it as part of their benefits package.

H2: How to Make the Most of Your Private Health Insurance

Once you’ve chosen a policy, here are some tips to maximize its benefits:

H3: 1. Stay Informed About Your Coverage

- Regularly review your policy to ensure it still meets your needs.

- Keep track of any changes in terms or premiums.

H3: 2. Use Preventive Services

- Take advantage of preventive care, such as health screenings and vaccinations.

- Early detection can save you from costly treatments later.

H3: 3. Keep Your Medical Records Updated

- Share your medical history with your insurer to avoid complications during claims.

- Keep a copy of your policy documents and contact information handy.

H3: 4. Explore Additional Benefits

- Many policies offer perks like gym memberships, wellness programs, and discounts on health products.

- Make the most of these extras to enhance your overall well-being.

H2: Conclusion

Private health insurance is no longer a luxury but a practical solution for many UK residents seeking timely and high-quality healthcare. With its numerous benefits, including shorter waiting times, access to specialists, and enhanced comfort, it’s an investment worth considering. By assessing your needs, comparing policies, and staying informed, you can find the right coverage to protect your health and peace of mind.

Whether you’re an individual, a family, or an expat, private health insurance offers the flexibility and security you need to navigate the complexities of modern healthcare. Don’t wait until it’s too late – explore your options today and take control of your health!